Finance

The finance and banking industry is moving to training management systems to onboard staff faster and reduce compliance risk. Administrate is the training management system of choice because it can connect with any existing technology to reduce operational burdens, insure audit-readiness, and connect training to business outcomes and bottomline ROI.

Technology Product Director, Wilmington PLC

Chief Digital Officer, Maersk Training

Head of Innovations Operations Enablement, Siemens Healthineers

Administrate empowers finance training teams to scale, automate, and prove the impact of their ILT programs.

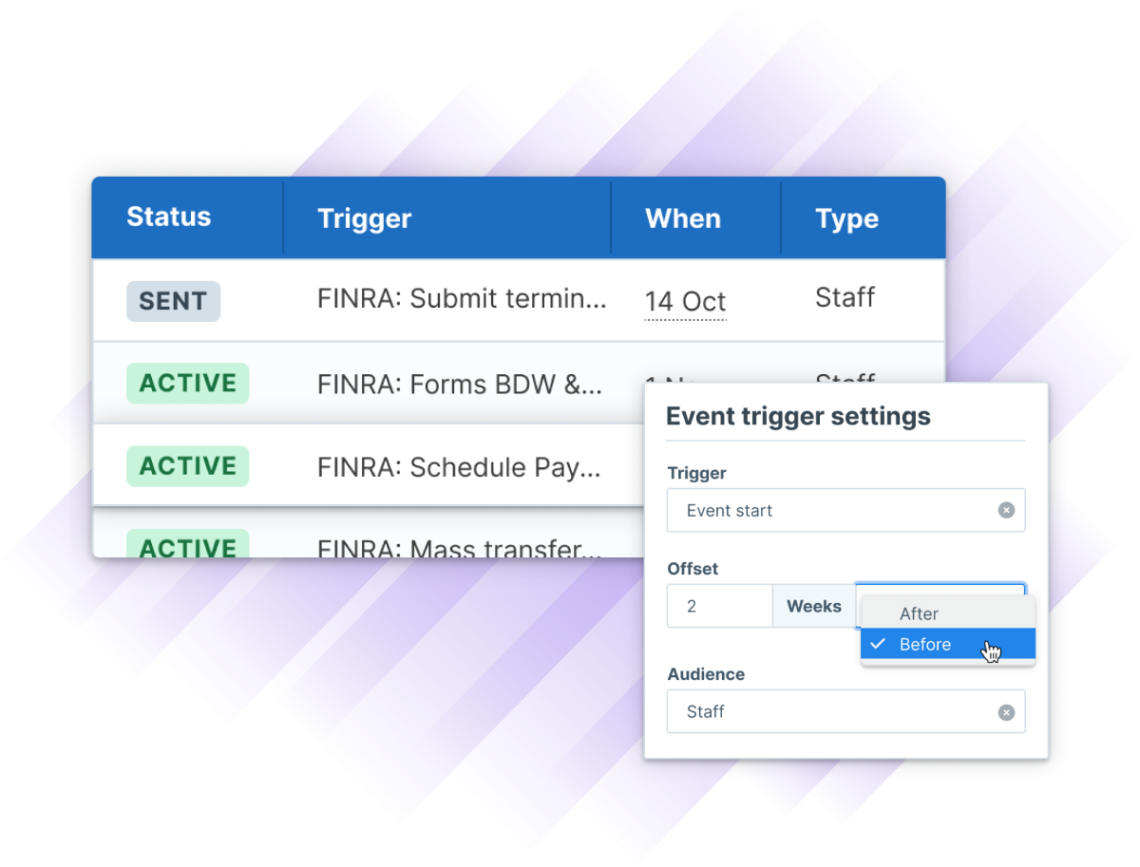

Improve your compliance posture by providing a centralized, automated platform to manage regulated training across roles, regions, and business units. Administrate ensures only qualified personnel are assigned to critical functions, automates refresher and certification tracking, and generates audit-ready reports aligned with FINRA, SEC, MiFID II, AML, and global regulatory standards.

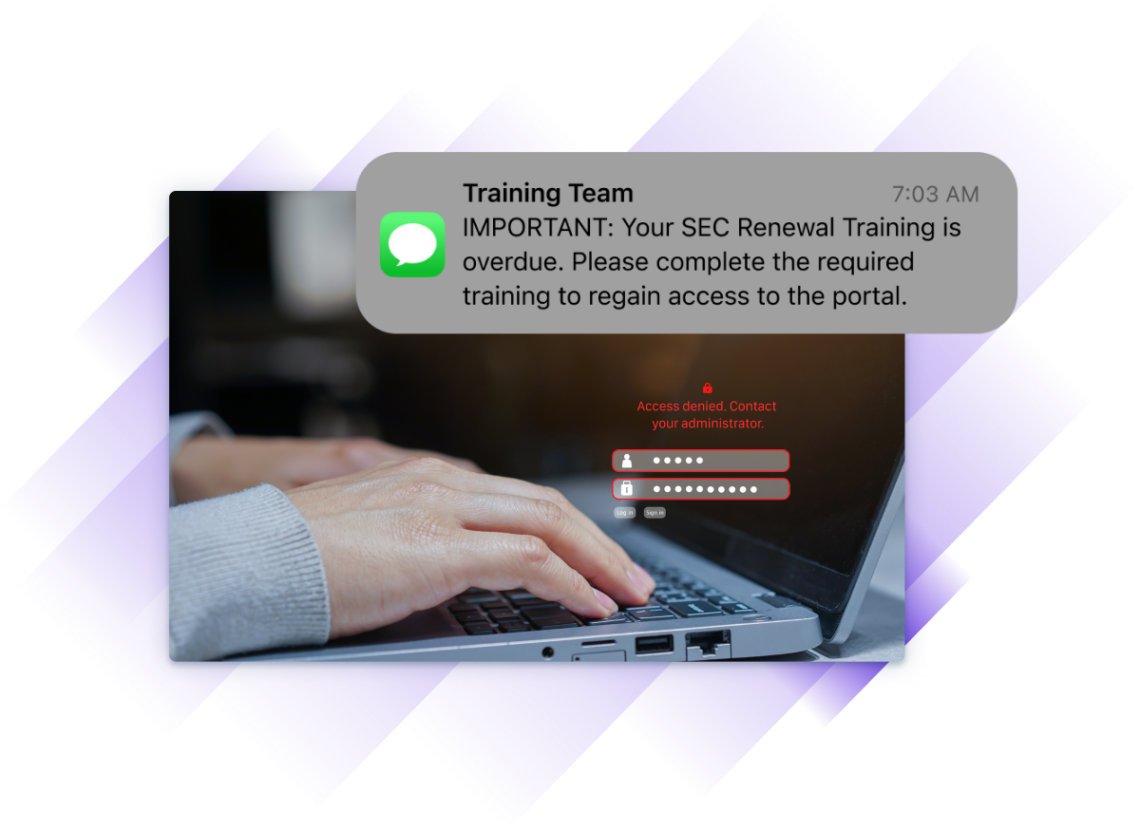

Automate training completions, certification tracking, and compliance deadlines. Restrict access to critical tasks until training is complete. Centralize training data to reduce regulatory breaches and audit failures.

Replace manual logistics with automation. Real-time insights help accelerate onboarding, reduce admin overhead, and drive strategic decisions that align training with compliance and financial goals.

See how Administrate can make meeting regulatory requirements painless for your training team.