Driving Training ROI in 2024

High inflation, cooling markets, and a pullback on investment have shaped a year of fiscal caution and shifting patterns of investment that impacted enterprise training programs across industries.

In 2023, we observed teams shifting investments from the classroom into online learning, and a growing rate of revenue per learner among teams selling training as their business model. The Great Return fizzled, inflation and economic uncertainty hit hard, and teams adapted with a financially cautious approach to an ever-increasing volume of learning needs.

As 2024 begins, these same economic and workforce pressures remain strong and challenges persist. Training teams sit at a critical junction. With the workforce in turmoil from mass layoffs, low job optimism, and lowered morale, anything but the highest quality training risks an under-prepared workforce. At the same time, high cost scrutiny and eminent cuts to L&D budgets are a constant threat to plans. Developing resilience to rapidly changing business conditions is no longer an option for L&D. It is a central strategy for enterprise training in 2024.

How will leading training programs evolve toward change-readiness this year? This report identifies trends revealed in our 2023 Administrate data and pairs it with expert analysis from seasoned L&D leaders. Through insights, recommendations, and case studies, you’ll gain a fresh look at the challenges and opportunities ahead for L&D.

About 2023 Enterprise Training Data Trends

Each year, Administrate aggregates, anonymizes, and analyzes the activity data produced by our users in an effort to pinpoint and interrogate emerging trends in the learning and development field. We publish our analysis of that data in our annual reports as a service to industry leaders seeking to inform their decisions in guiding mission-critical training.

Our report includes trend analysis of the following industries:

- Agriculture

- Compliance

- Construction

- Education Management

- Financial Services

- Higher Education

- Hospital & Healthcare

- Hospitality

- Information Technology

- Management Consulting

- Oil & Energy

- Professional Services

- Sports & Leisure

- Transportation & Logistics

The 2023 Report’s Companies By Industry

Insights from Training Leaders

We’ve partnered with leading experts in the training field to offer their perspectives throughout our 2023 report. With real world insight, they discuss valuable context and innovative applications for enterprise training decision makers in 2024.

2023 Enterprise Training Trends and Insights

Critical trends that will guide your decision making in 2024.

The data reveals several strong trends in the corporate learning space where common strategies for weathering difficult economic times have won out. Let’s break down two of the most significant trends and why we expect both to continue into 2024: a surge in online learning investment and a rapid increase in training revenue per learner.

2024 Trend: Surge In Online Learning Continues

Training teams lean on eLearning and vILT to control costs and conserve ROI.

At the start of 2023, many anticipated a surge in classroom training as employees returned to the office. But, as we know, the Great Return was not so great. Remote and hybrid working models are the new, permanent norm for many businesses. While in 2023, we did see an overall upward trend for classroom events, that trend was dwarfed by growth in online learning events. Training teams not only maintained but many expanded their virtual learning environments in response to evolving workplace dynamics.

This trend is clear in our 2023 training data, as this sample set reveals.

- Construction

- Financial services

- Higher education

- Education management

- Professional services

Within these industries, the increasing volume of eLearning and vILT events has greatly outpaced growth of classroom events, displacing the classroom’s total share of training events. Training programs are leveraging tight resources to meet learners where they are, and for many, that is not in the office.

This surge in online learning modalities’ popularity comes down to two factors: cost and changing workplace culture.

On the cost side, classroom events have significantly higher costs per learner and great logistical challenges. Training leaders anticipated major budget cuts in 2023. And they weren’t wrong – average L&D spend per employee at large companies in 2023 was less than half of what it was in 2023. Under that level of pressure, aggressively managing costs isn’t optional. That’s more than enough reason for many programs to invest selectively and target the lowest-cost methods of training delivery available, which will overwhelmingly be online modalities with few logistical expenses associated.

Workplace norms are another major influence in the continuing expansion of online learning. With the data suggesting that employees value working from home as much as a substantial raise, and that the productivity of hybrid and remote work is equivalent to in-office work when accounting for the costs of office space and commuting, remote and hybrid working are here to stay for many industries. Innovation is climbing here as well, as companies seek ways to incite and inspire valuable employee engagement to combat turnover and limit hiring costs.

From a training perspective, this makes delivering high quality learning experiences with great flexibility a central deliverable for training teams in 2024. Kevin Streater, Consultant in IT and Cybersecurity Professional Development, with more than 25 years in the industry, puts it:

“With businesses establishing hybrid working models of 2-3 office days per week, or allowing more workers to work completely remotely, the number of in-office days is limited. This also limits the number of days that employees are available for classroom events, putting pressure on training teams to deliver more flexible online learning options so that employees can complete their training from home.”

For some industries, however, the value of classroom training is irreplaceable. There were a few major industries in our data that bucked this trend, and did show major investment into classroom learning: Compliance, Management Consulting, Hospital & Healthcare, and Transportation & Logistics.

Consider the performance of classroom training for these sectors.

What’s driving the surge? Hospital & Healthcare for example, represented in our data by medical device manufacturers and medtech companies, require in-person, hands-on training to sell and deliver their high-value equipment and high-risk services. Compliance requirements further enforce this modality. As these industries boom and quickly onboard in response to an epidemic of staff shortages, classroom training tools and efficiencies will follow. Leading training teams in these verticals are already investing in resource management, an infrastructure approach to learning technology, and task automation as essential to lowering the costs of essential classroom training.

Later on in this report, we’ll address our thoughts on why the compliance and healthcare data should be considered separately, as industries facing unique challenges and opportunities in 2023. For Management Consulting and Transportation & Logistics, we feel that this data most likely has more to do with the specific choices made by the companies in our datasets than with any broader trends in corporate learning.

Training Revenue Per Learner Grows In 2023

Despite global economic headwinds in 2023, we noted strong growth in revenue from the training companies that charge for training—growth that outpaced the number of new learners they added.

Revenue outperformed the number of new learners by a substantial margin, meaning that this growth cannot be fully explained simply by more learners being charged for training. Instead, in most industries, revenue generated per learner rose substantially in 2023. Take a look at the following industries where this trend appears strong:

- Compliance

- Construction

- Education Management

- Hospitality

- Management Consulting

- Oil and Energy

- Professional Services

What’s contributing to the growth? The data shows that increasing the volume of training per learner is likely the primary driver of higher revenue. Growth in the number of active events held by our user base outpaced the increase in new learners, implying that learners are attending more events, not just paying more per event. This correlates well to the well-documented spike in training needs associated with high turnover and workforce shortages. Watching revenue performance for training companies may be a revealing leading indicator as 2024 continues and budgets adjust with economic changes.

For internal training teams, this data offers the opportunity to consider opening up potential revenue streams. The market is proving capable of supporting higher prices for training in 2023 and continuing into 2024—are there customer or other external training courses that could be turned into a revenue stream for your company or organization? Could your organization implement cost-covering fees for some employee training? The timing may be right to pilot extended enterprise training projects suh as customer and vendor training that drive the profit center value of L&D.

“Focus on delivery methods has helped teams to increase revenue per learner in 2023. Heavy investments into online learning modalities make it easier to deliver more content to learners while staying flexible and adaptive to their needs, enabling teams to deliver higher volumes of content and more focused content that learners and organizations are willing to pay a premium for.At the same time, many training companies are boosting revenue simply by changing their pricing models. Subscription models, for example, have shown the potential to boost revenue by more than half without substantial new content. Offering learners unlimited access to on-demand libraries of training, rather than charging per-course or per-session, reduces friction and increases their perceived value-for-money, making this an increasingly popular model. Other approaches, such as modularizing content or repackaging existing content into just-in-time or bite-sized training offerings, are also developing avenues for boosting revenue per learner simply by changing how training is delivered and sold. ”

Unique Industry Trends In Learning And Development

Three industries that bucked trends in 2023, and why they matter.

The trends of surging online learning and growing revenue per learner dominated the vast majority of our industry groups in 2023, and we expect them to continue to dominate 2024. However, there are outliers, and we want to talk about four of them.

These three industries—Hospital & Healthcare, Information Technology, and Compliance—experienced a radically different year than most of our dataset did. It’s important to remember that the Administrate userbase is a limited sample compared to the full industry, but within that sample, these four industries presented a radically different trajectory from the rest of the L&D space we observed. Two of them experienced a year of high variability, for a variety of reasons, while one, Compliance, posted a banner year of surging training activity. Let’s break down each of these four cases and explore why they bucked the trends—and what they can expect going into 2024.

Hospital & Healthcare

Hospital & Healthcare companies in the dataset saw a mixed but largely negative trend across key activity metrics. While average monthly active training events grew by 26.95%, and monthly classroom events by an astonishing 123.86%, most other major metrics declined over the course of 2023 compared to the 2022 baseline. Monthly learners on events declined a dramatic 94.15% in our data, while average monthly learners created fell by 53.28% and email volume by 50.13%.

Far more events, and far more classroom events, being conducted with far fewer learners assigned to those events perhaps implies a shift towards much smaller class sizes, or more 1-1 learning events. This is an area we’ll be watching as 2024 unfolds.

Information Technology

Information technology had a volatile 2023, with a pullback from venture capital and investment leading to painful workforce cuts within the highly financing-dependent industry—even among top players and some of the most profitable companies in the world. With tens of thousands of information technology workers being laid off in 2023, the industry’s trend for L&D activity was bound to be affected.

Average monthly learners on events declined by a steep 50.33%, and average monthly active events declined by 6.33%, indicating fewer events being held and far fewer learners attending those events—telltale signs of a pullback in total training volumes. However, there were areas of growth—an astonishing 126.16% increase year-over-year in monthly courses created, for example, as well as a more modest increase in monthly learners created of 61.61%.

This finding indicates a shift in emphasis from employee training towards customer training within the information technology sector. Reduced headcounts are being more than counterbalanced by the adoption of extended enterprise principles among top software companies, who are targeting customers, vendors, and other external learners to expand training operations even in the face of lowered demand for employee training.

John Leh, CEO of Talented Learning, sums up the push for increased customer training succinctly in his 2024 Learning Systems Predictions:

Customer education is the exception to declining demand for LMS replacement. Because requirements are unique (compared with employee-focused systems) and these platforms measurably contribute to business outcomes, customer education programs have ample motivation and resources to invest as they grow and evolve.

Responding to these changes and increased demand for training from external sources has driven changes in the learning technology stack at information technology companies. Information technology companies sit at the intersection of interlocking and complex demands on their training technology: demand for fine-tuned control of the learner experience, the need for accurate reporting to inform product development, and the need to deploy a unified training experience and data architecture globally.

As a result of these colliding priorities, learning technology stacks in the information technology sector are being overhauled at a fundamental level. As Kevin Streater puts it:

“Across all industries, but especially in the information technology space, there has been a move away from on-premise and hybrid cloud learning technology solutions towards fully SaaS-based tech stacks. Companies are building capacity by investing into flexible SaaS platforms that provide them with more fine control than older technology solutions offered, and more flexibility to shop around and switch platforms to meet their needs. That in turn has put more pressure than ever on vendors to provide built-in functionality and training offerings in their platforms.”

On-premise and hybrid software is difficult to deploy for customer and vendor training. The majority of recent developments in the tech space have been purely cloud-based, meaning that a shift away from on-premise software enables companies to rapidly deploy and expand their offerings at scale.

Compliance

Though most industries in our dataset showed signs of variability in 2023, one industry in particular showed almost universal growth in the metrics we captured. The trend in compliance learning and development has been resoundingly positive for 2023, with the industry showing strong growth overall. Notable statistics include a 31.19% growth in average monthly revenue, a 40.16% growth in average monthly courses created, a 28.72% growth in average monthly classroom events, and a 25.59% growth in average monthly active events.

Strong compliance growth in 2023 and continuing into 2024 has been driven primarily by two factors: ESG regulation and consumer data privacy regulations.

European regulators continue to increase ESG standards, in every industry, necessitating extensive retraining and recertification in many industries in order to maintain compliance. And regulators show no signs of slowing down: new EU ESG transparency and reporting rules went into effect on Jan 1, 2024, and will continue to roll out for the next few years, ensuring demand for compliance training will remain high in that region.

Meanwhile, globally, but especially in the United States, new data privacy regulations in compliment to the European Union’s GDPR regulations are coming into effect, driving further spending on compliance. In particular, state level data privacy regulations have spurred major changes and required extensive employee training to adapt.

“The impact of growing global data privacy regulations cannot be understated – especially the California Consumer Privacy Act. This Act follows from the European implementation of GDPR, and provides tougher standards for handling Californians’ consumer data. Because of the size and importance of California’s market, this has made compliance with the Act mandatory for almost all companies with operations in the US. Data privacy compliance is almost certainly one of the main drivers behind growth in the compliance sector for the last year, and the global regulatory framework on consumer data privacy is only likely to get stronger, ensuring this will remain a strong driver for years to come.”

Top 3 Priorities of Enterprise Training Teams in 2024

Strategies we’re already seeing in Q1.

In 2024, teams will continue to face the challenge of balancing rising costs with rising demand while demonstrating a strong ROI to retain budget. The question then remains: what steps will forward-thinking L&D leaders take to improve their training programs in 2024?

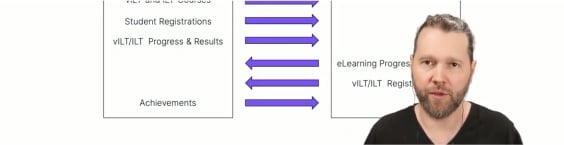

1. Improve Data Management and Access

When budgets are tight, every decision matters. Ensuring accurate, accessible training data is vital to informing those decisions. Many training teams battle a fundamental lack of access to the raw data needed to fully assess their business impact. Their numbers sit locked inside prefabricated reports or behind a paywall of developer time. Much of the training software on the market today fails to provide adequate data access and management infrastructure and lacks the flexibility for holistic analysis. Though reporting on training data is its own challenge – one we’ll discuss next – this problem often runs deeper than simply not having the right reports.

With the workforce and training demand challenges of 2024, full, open access to training data is no longer optional. Training teams need data accessibility and a data management infrastructure that’s tightly integrated with organizational KPIs, aggregating data from systems automatically, and managing data according to industry best practices. The risk of duplicated databases, errors from manual interaction with data, and lack of data accessibility are too costly to ignore in 2024.

Building an infrastructure intended to capture and manage L&D data will provide training teams with a strong foundation for informing strategic business decisions, in 2024 and beyond

2. Automate Communications and Reporting

Body Text: Efficiency is in high demand. Investments in the automation of repetitive administrative and managerial tasks are a central concern for teams faced with the task of doing more with less. Seasoned L&D leaders are prioritizing technology solutions that allow manual work to be automated allowing team members to make higher value, strategic contributions.

Communications associated with day-to-day training management is one area where technology solutions are being demanded. Learners, instructors, vendors, facility managers, equipment owners, departmental stakeholders, compliance auditors all require communication before a single course is delivered. Many teams still rely heavily on manually generating and sending these communications, but more and more programs are turning to effective training management software to send sweater emails and more.

Similarly, reporting is another common task that requires training teams an excessive amount of time and often provides limited visibility into training business outcomes and opportunities. With a multitude of systems and tools, training teams are required to aggregate and analyze data manually, leaving most unable to share the full story of how training is nor only supporting but als driving the business. As John Leh, CEO of Talented Learning, put it in his 2024 Learning Systems Predictions:

“Meaningful measurement is the holy grail of training. For over a decade, I’ve preached about the measurable nature of customer/partner education. It’s hard to find an externally focused training program that isn’t proving its business value. For decades, others have preached about measuring the impact of employee training, but methods and tools have been fuzzy at best.”

Many systems have outdated and underdeveloped reporting functions that are difficult to use. Considering that most training teams utilize 12+ disparate systems to plan and deliver training, any data aggregation and analysis is highly manual. Investments into a data management architecture designed to support your program can help streamline the process of pulling the data necessary for reporting. Once that architecture is in place, it provides a foundation for integration-powered, automated reporting engines, eliminating even manual work and reducing the risk of human error.

Capitalizing on automations in communications and reporting are two of the most active innovation areas in training management in 2024. Adoption of these emerging technologies will become a defining factor of success for training programs in 2024.

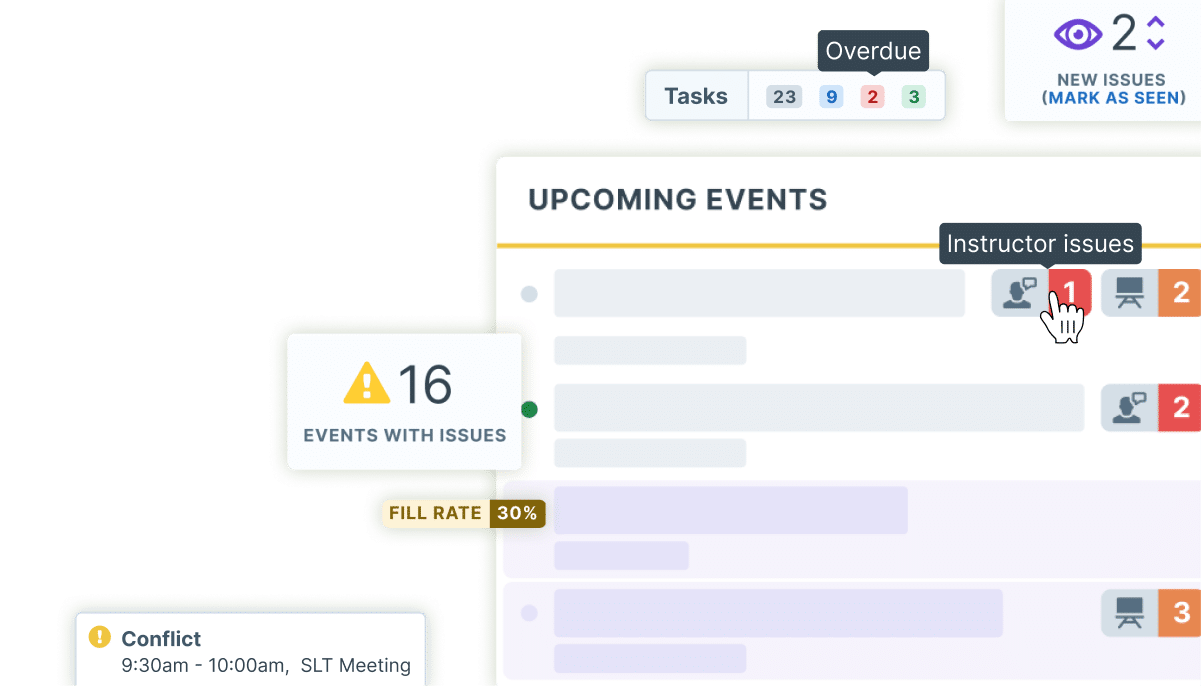

3. Leverage AI for Resource Management and Scheduling

Many in L&D have already caught the vision of leveraging AI for content, but the next AI frontier offers an even greater business impact: AI for training operations. Today, it’s not unusual for enterprise training teams to spend an entire month focused on creating a master schedule. Inevitably, soon after the schedule is out, changes emerge and the conference room wall fills with sticky notes once again to reconcile the plan.

But training management technology is catching up to established resource management tools. AI-powered L&D scheduling tools, integrated into training management systems, have been developed to automate the process of generating schedules and booking resources to deliver a full master schedule in minutes. In addition to schedule production, these AI tools also provide proactive intelligence on resource utilization and underbooking or overbooking issues to be resolved. Once again, from John Leh, CEO of Talented Learning, in his 2024 Learning Systems Predictions:

“Without a TMS, it’s insanely difficult to schedule a quarterly or annual training calendar with 100s or 1000s of course instances, locations, instructors, training materials, equipment, hotels, meals, vacations, travel, labs, e-commerce and other elements. Spreadsheets and manual administration are woefully inadequate. Because this process is so complicated, the TMS corner of the learning system market doesn’t receive much airtime. But for those who benefit, it makes a massive difference.”

2024 will be dominated by budget pressures and a need to deliver high-quality training while managing operational costs. Teams will need world-class software and data management architecture solutions to streamline operations, automate common tasks, fully access and leverage their data, and more. Efficiency will be the difference-maker for your team in 2024. Data infrastructure is the key to mastering it.Final Word